Articles

Transforming customer onboarding across regulated industries with EUDI Wallets

Learn how EUDI Wallets, together with Business Wallets, can enable faster, more secure onboarding, including KYC, legally valid contract signing and passwordless login and more across regulated industries.

From piloting KYC and contract signing in banking to cross-industry adoption

This article is based on the presentation and live demo delivered at the EUDI Wallet Launchpad Event in Brussels on 10 December 2025 by Lal Chandran (CTO, iGrant.io) and Viky Manaila (Trust Services Director, Intesi Group). It demonstrated how an organisation-operated Business Wallet can integrate with an individual’s EUDI Wallet to complete KYC, execute qualified signing, and establish a foundation for secure ongoing access.

Digital onboarding is no longer a supporting process. It is the first meaningful interaction in which trust is established, compliance is demonstrated, and the customer decides whether to continue or abandon. Across banking, telecoms, insurance and adjacent regulated sectors, the scale is significant, with hundreds of millions of digital onboarding events each year and a direct link between onboarding journeys and downstream payments and account usage.

At the same time, identity-based financial crime and onboarding fraud have become board-level topics. The EU Prosecutor’s Office has reported estimated damages investigated in relation to identity-based financial crime at €24.8 billion. This risk sits alongside a structural cost problem. Onboarding remains slow and operationally heavy, and it frequently fails the user experience test.

The onboarding problem is measurable

In traditional onboarding, the customer experience breaks down in predictable ways:

- Repetitive data entry across forms and channels

- Failed verifications driven by document capture and liveness false rejections

- Cross-border delays for non-local applicants

- High abandonment before completion

The cost profile is equally clear. Typical successful onboarding costs of €23 to €45 per customer, abandonment rates of 35 to 50% in traditional banks, and onboarding cycle times ranging from 45 minutes to multiple days, depending on risk and document review.

Operational friction is often driven by document verification failures that force manual review. The same material cites failure rates of 20% for proof of address and 15% for ID scans as examples that trigger rework and delay.

In aggregate, onboarding is characterised as costly and labour-intensive, with significant resources dedicated to customer onboarding and billions of euros spent on successful onboarding while fraud attempts rise.

A practical scenario: “Anna opens a bank account abroad”

The challenge can be illustrated with a common cross-border onboarding situation: a citizen relocating to another country needs to open a bank account. Today, this often involves submitting document scans and proof of address, waiting through manual checks, and managing paperwork across multiple channels, which creates friction and increases operational risk.

This scenario is representative because it concentrates on the three core constraints that regulated providers face:

- Trust: the organisation must establish confidence in the customer’s identity and evidence

- Compliance: KYC and AML controls must be met with audit-quality proof.

- Conversion: the process must still feel simple enough to complete

What changes with EUDI Wallet-based onboarding

With EUDI Wallet-based onboarding, organisations can move away from uploaded documents and repeated data entry towards cryptographically verifiable credentials presented from a wallet. This enables consistent, near real-time verification and a simpler, more secure onboarding experience for customers in regulated sectors.

In the banking-focused use case flow, the target outcome is an integrated onboarding flow that combines:

- KYC evidence collection and verification

- Contract review and qualified signing

- Issuance of a bank authenticator to enable passwordless login, SCA, and payment initiation journeys

This matters because it reframes onboarding as the gateway to the full digital relationship, not a one-off hurdle.

EUDI Wallet-based onboarding: How will this work in practice?

The demo shows onboarding as a connected sequence rather than separate “identity”, “signing”, and “login” silos.

- Start onboarding in the bank portal: The user begins in a familiar web or mobile channel.

- Present verified attributes from the EUDI Wallet: The bank requests the required evidence (for example, identity and address-related attributes). The wallet presentation is designed to reduce re-keying and document handling.

- Complete contract signing in flow: The customer reviews the contract and completes qualified signing using wallet-based signing capabilities, supported by qualified trust services.

- Issue a bank authenticator for ongoing use: Once KYC and contract signing are complete, the bank can issue a bank authenticator to the user’s wallet. This enables passwordless login and supports Strong Customer Authentication (SCA) for day-to-day banking and payment journeys.

The net effect is that onboarding produces a reusable digital capability: the user exits onboarding ready to transact securely, without reverting to passwords or fragmented step-up methods.

You can view the full onboarding workflow demonstration video below:

Reference architecture: Integrate without replacing the bank

This architecture is commercially important because it supports incremental rollout. Banks and other regulated providers can start with a narrow set of onboarding use cases and then expand to login, SCA, and payments once the foundations are stable.

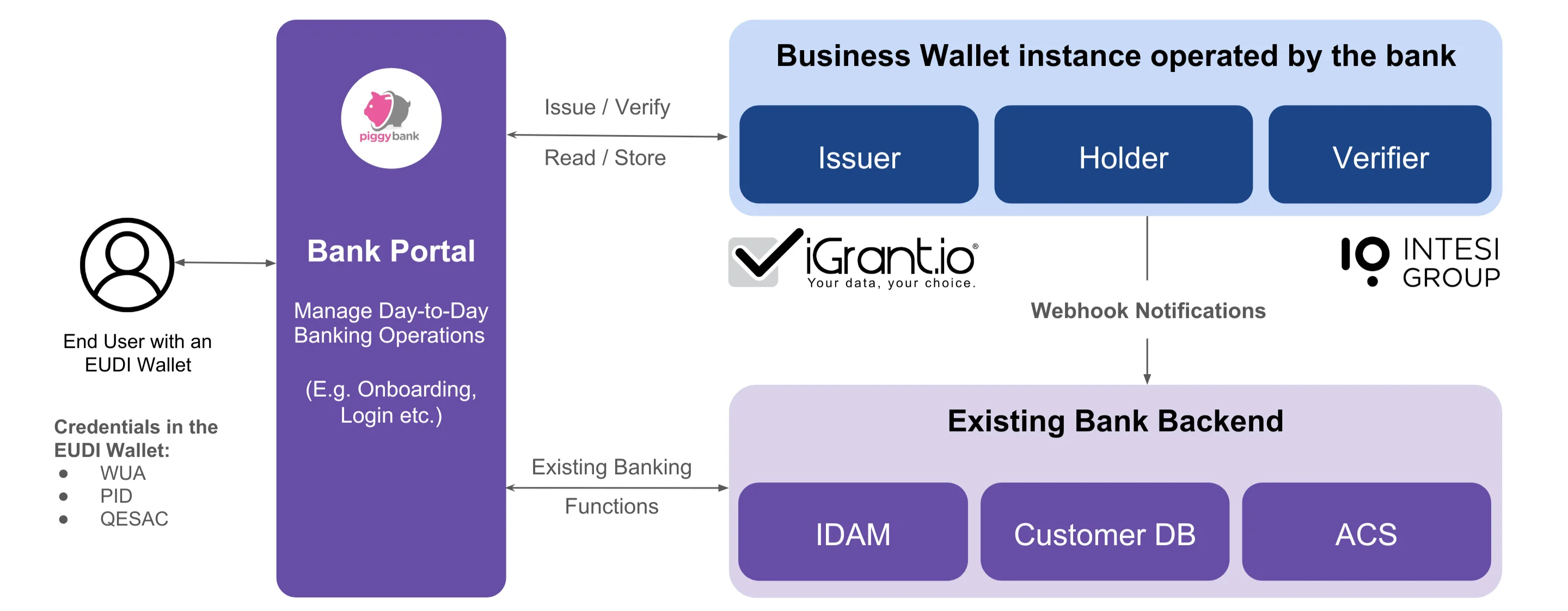

A key point in banking is that EUDI Wallet onboarding can be introduced as an extension to existing banking processes, rather than a wholesale replacement. As illustrated, the deployment model includes:

- Bank portal: where onboarding and login journeys are initiated

- Business Wallet component: acting as issuer, holder and verifier functions for wallet-based interactions

- Bank backend: connected via webhooks and integrated into existing systems such as IDAM, customer databases, and access control services

- Existing credentials used in the flow (examples shown include WUA, PID, and QESAC)

Why does this extend beyond banking?

Although the demo focuses on the bank account opening journey, this is not just about banking. It positions onboarding as the gateway to full digital experiences across regulated industries, emphasising scalability, certification readiness, and broad adoption.

The same pattern is transferable wherever an organisation must reliably establish identity, collect verified attributes, sign regulated agreements, and then enable secure ongoing access. Insurance policy onboarding and telecom subscriber onboarding are obvious adjacent targets because the underlying pain points are similar: document-heavy KYC, cross-border friction, rising fraud, and high abandonment.

Practical adoption guidance for regulated providers

For executives planning adoption, the fastest route to value is typically:

- Start with one onboarding journey with apparent abandonment and manual review pain.

- Define the minimum credential set needed to approve the relationship (identity and residential address are common starting points)

- Integrate verification and evidence capture into existing onboarding channels.

- Add qualified signing where contracts are bottlenecks or sources of dispute risk.

- Issue an authenticator credential to convert onboarding into a reusable login and SCA capability.

Closing: Onboarding as a trust and growth lever

EUDI Wallet-based onboarding reframes a costly compliance obligation into a competitive asset. It reduces friction for genuine customers, increases data quality through verification, and strengthens fraud resistance by moving away from scanned documents and repeated manual checks.

Most importantly, it turns onboarding into a foundation for ongoing secure digital interactions: passwordless login, SCA-aligned authorisations, and transaction readiness, delivered through a unified wallet experience.

Do reach out to [email protected] or contact Intesi Group for more info.