Articles

Executive summary: European Business Wallet Regulation (2025)

Key takeaways from the proposal for a regulation on the establishment of European Business Wallets (EBWs)

You can download the executive summary as a PDF here.

Table of Contents

The European Commission has proposed a new regulation to create European Business Wallets (EUBWs), a harmonised, trusted digital tool designed for secure, cross-border interactions between economic operators (companies of all sizes, including SMEs, sole traders, and self-employed persons) and public sector bodies across the EU.

This complements the European Digital Identity Wallet (EUDI Wallet) and forms a critical part of the EU’s competitiveness, digitalisation, and simplification agenda for 2024-2029.

1. Purpose of the regulation

The regulation aims to:

-

Reduce administrative burdens for businesses, especially SMEs.

-

Strengthen cross-border recognition of digital identity, attestations and documents.

-

Enable seamless B2G, B2B and B2C data exchange with full legal effect across the EU

-

Boost competitiveness and digital-by-default public services.

-

Increase trust, security and traceability for business-related digital transactions.

2. Why is it needed?

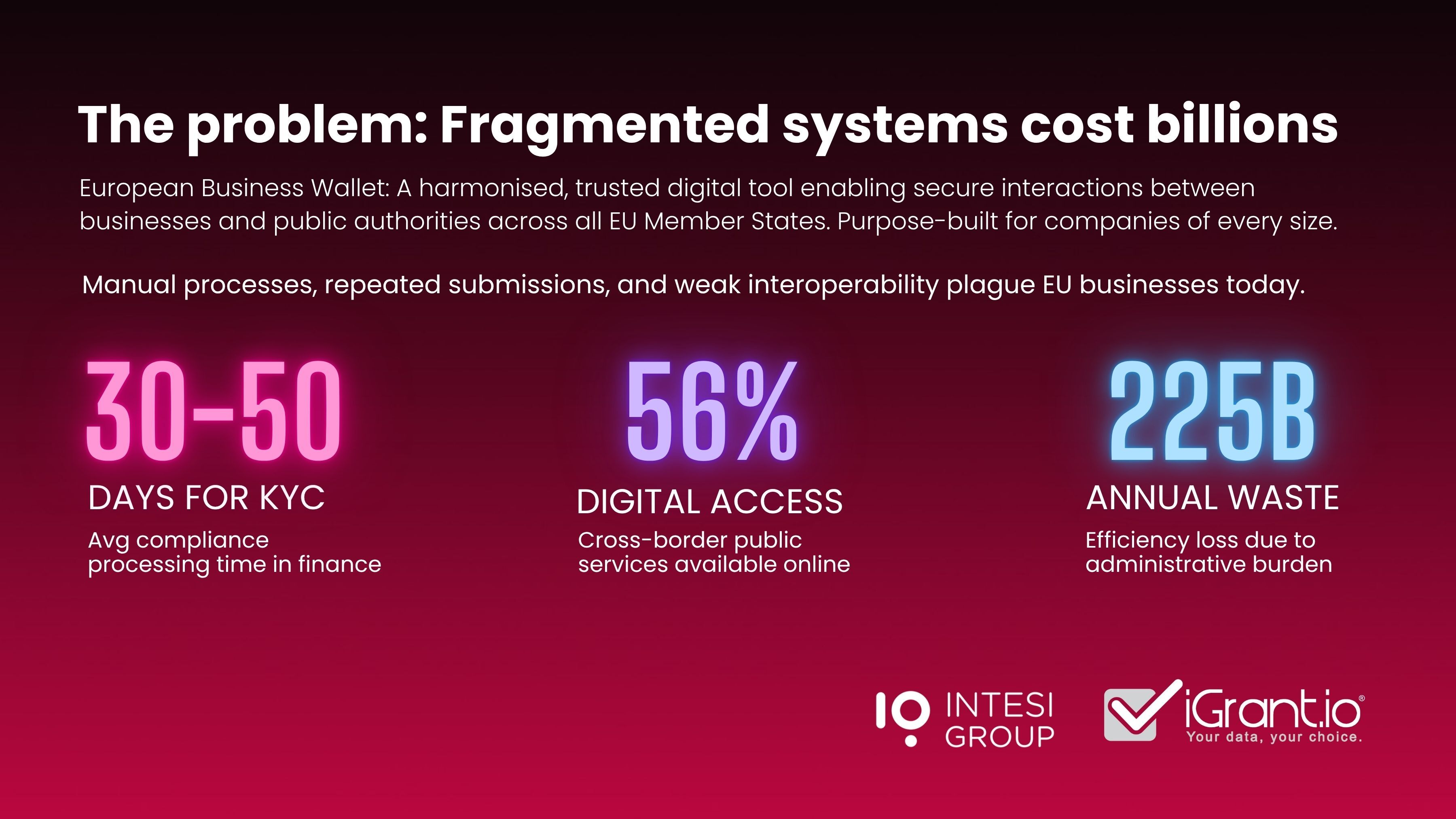

Current processes across Member States are fragmented, manual and costly. Key challenges addressed include:

-

Repetitive submissions of the same documents to different authorities.

-

Long processing times in compliance workflows (e.g., KYC taking 30–50 days).

-

High cost of regulatory reporting.

-

Weak cross-border interoperability (only 56% of public services are accessible digitally to cross-border users).

-

Security risks due to email-based document sharing (e.g., invoice scams).

The proposal responds to major EU reports (Draghi, Letta), the Digital Decade targets, and Council requests for “simplicity by design”.

3. What the Business Wallet will provide

Store and share verified identification data and attestations

| Identification and authentication | Secure digital identification of the business with legal effect across borders. |

|---|---|

| Electronic signing and sealing | Ability for authorised representatives to sign documents using eIDAS-compliant electronic signatures/seals. |

| Document and data exchange | All documents, structured data (attestations), declarations and applications can be submitted digitally. |

| Legally valid notifications | Integration of Qualified Electronic Registered Delivery Service (QERDS) for secure official communication. |

| Mandates and delegation management | A role-based access system enabling organisations to issue and manage mandates internally (compatible with EU Digital Power of Attorney). |

| Storage and management of verified attributes | E.g. VAT number, EUID, LEI, licenses, certifications, permits, tax identifiers. |

| Interoperability with EUDI Wallets | Sole traders and self-employed persons may use their personal EUDI Wallet to access business-related trust services. |

4. Obligations for public sector bodies

All public sector bodies, including EU institutions, must:

-

Accept EBWs for identification, authentication, signing/sealing, and document exchange.

-

Enable submission and receipt through the secure communication channel.

-

Implement these capabilities within specified transition timelines.

-

Hold a Business Wallet to interact with companies.

This makes EUBWs a mandatory acceptance channel for authorities, though companies’ use remains voluntary.

5. Providers and Governance

-

Providers must be established in the EU, not controlled by high-risk third-country entities.

-

They must meet security, reliability, and interoperability requirements.

-

Supervision is ensured by national eIDAS supervisory bodies, in coordination with the European Commission.

-

The European Commission will publish a Trusted List of Business Wallet Providers.

6. Owner identification and authentic sources

Identification of wallet owners is based on:

-

Qualified electronic attestations of attributes, issued by:

-

Qualified Trust Service Providers

-

Business registers

-

Member State authentic sources

-

European Commission (for EU entities)

-

The wallet must use the European Unique Identifier (EUID) where available. EUID is the official EU-wide identifier for companies and legal entities, defined in the EU Company Law Directive (2017/1132) (Annexe 9).

7. European digital directory

A new EU-wide directory will list all economic operators and authorities equipped with a Business Wallet, enabling:

-

Discoverability

-

Addressing secure communication

-

Reduced friction in B2B/2G/B2C interactions

-

Operated by the Commission.

8. International dimension

The EU may recognise equivalent business wallet frameworks of third countries, provided they meet high security and interoperability standards.

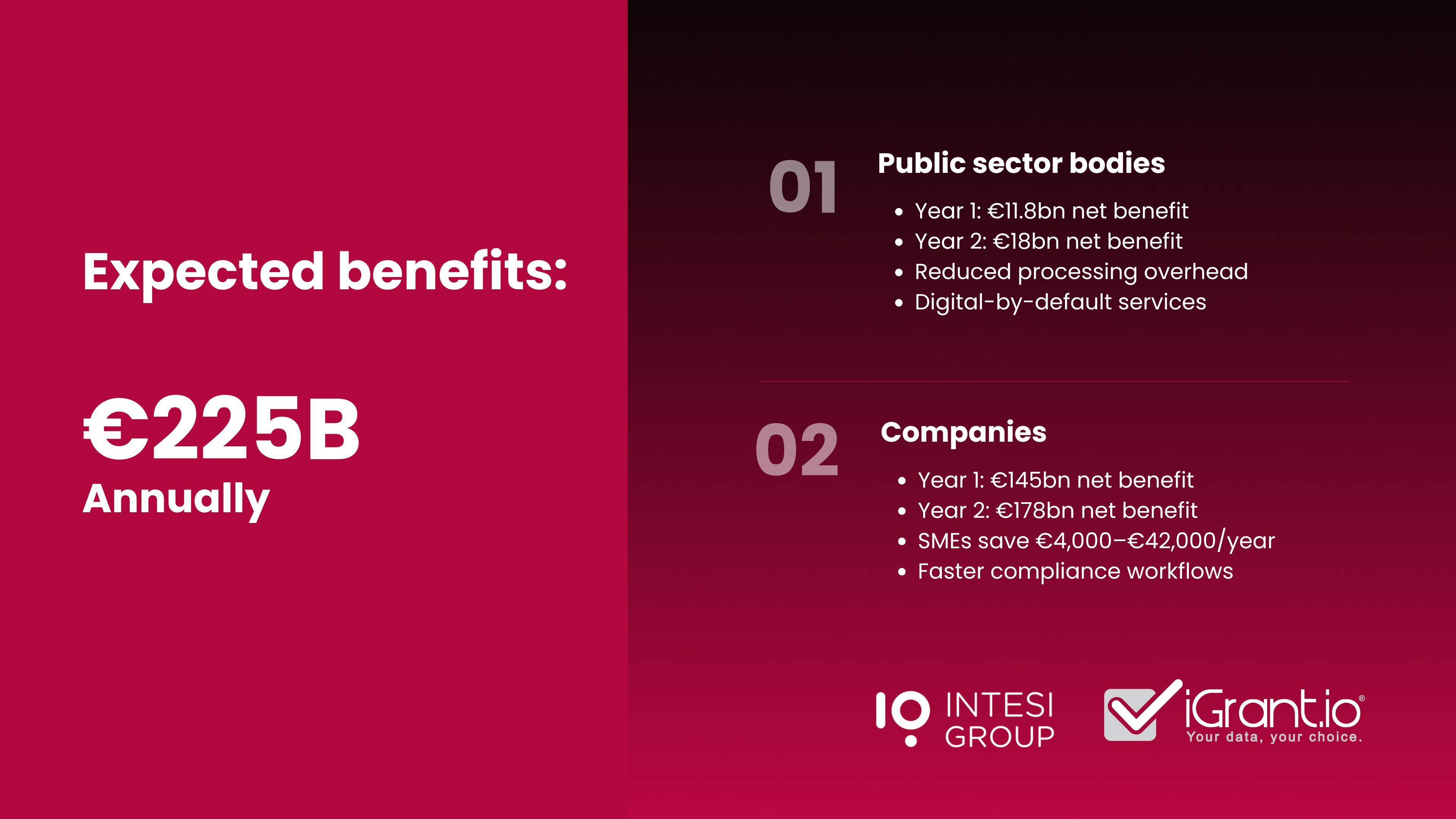

9. Expected benefits (quantitative)

According to the Staff Working Document, the annual cost-savings potential that the European Business Wallets can bring from replacing all manual processes with streamlined digital processes, once fully adopted, is €225 billion

10. Strategic impact

The European Business Wallet will:

-

Become the standard interface for digital interactions between business partners, their customers and authorities.

-

Enable interoperability with major EU systems (OOTS, BRIS, BORIS, ViDA, DPP, IEA).

-

Strengthen digital sovereignty by reducing dependency on high-risk non-EU providers.

-

Serve as the digital foundation for the 28th Regime for EU-wide company operations.

11. Where can Business Wallets be used?

Some examples of high‑impact business and supply chain use cases include:

-

Due Diligence, KYC / KYB: Support financial institutions and obliged entities via a Business Wallet to verify customer identity before granting access to services.

-

Company Law Directive - Branch Creation: Enable businesses to register a branch abroad using a Business Wallet.

-

Company Representation & Signing on behalf of a company: Digitally empower natural persons to act/sign on behalf of companies for tax compliance, cross‑border transactions, invoicing, and more.

12. Conclusion

The European Business Wallet Regulation is a major step toward a seamless digital single market for businesses. It creates a unified, secure and trusted framework for business identity, attribute verification, digital signing and cross-border interactions. It complements the EUDI Wallet and delivers the EU’s goal of reducing administrative burden, enabling digital-by-default services and enhancing competitiveness, particularly for SMEs.

Click here to book a demo of iGrant.io Organisation Wallet Suite